The Challenge of Wealth Transfer

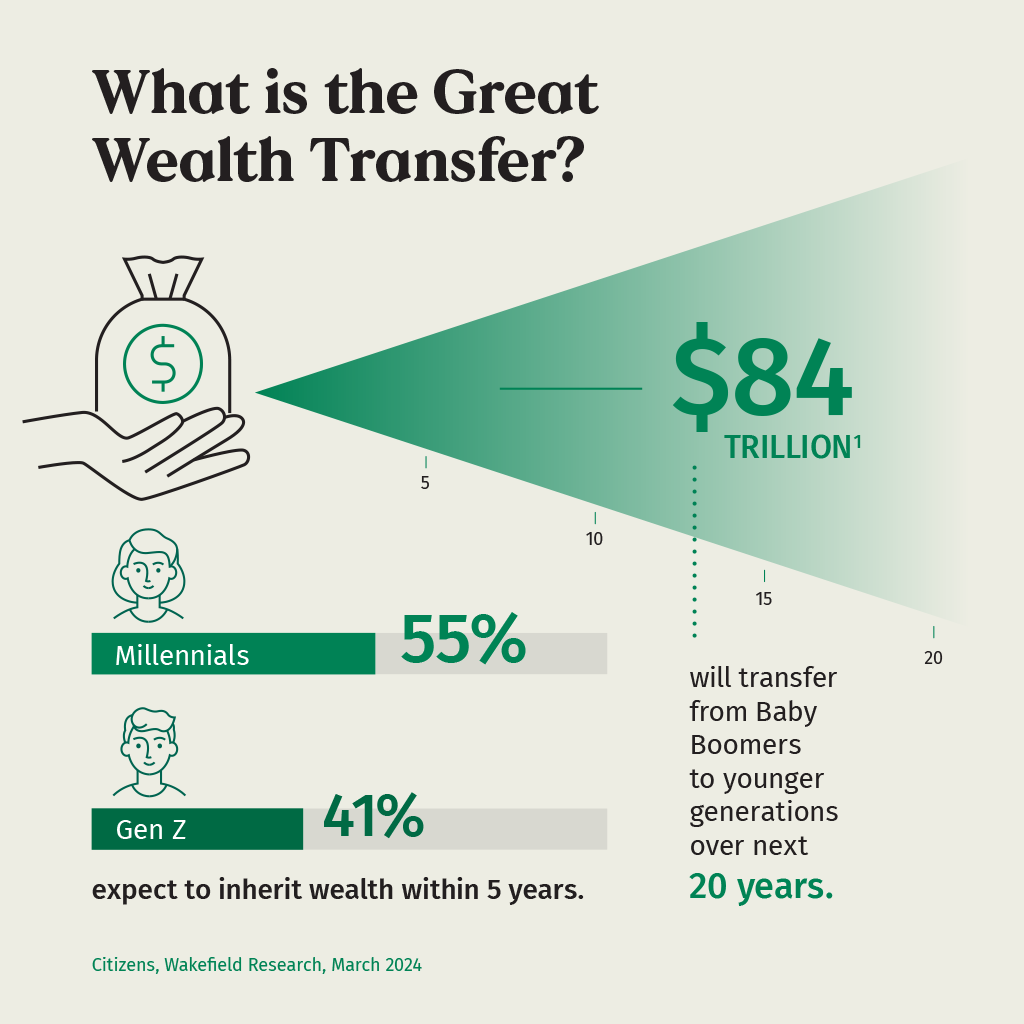

Every year, an estimated $84 trillion will be transferred between generations in the United States over the next 25 years, representing the largest intergenerational wealth transfer in history. Despite this massive shift of wealth, studies show that 70% of wealthy families lose their fortune by the second generation, and 90% lose it by the third generation.

This phenomenon, often called the "shirtsleeves to shirtsleeves" cycle, occurs not due to market forces alone, but primarily from lack of preparation, poor communication, and inadequate governance structures. The most successful multigenerational families share common characteristics: clear values transmission, structured education programs, and professional guidance throughout the transfer process.

Key Success Factors

Families that successfully preserve and transfer wealth across generations typically demonstrate: clear communication about wealth and values, structured education about financial responsibility, professional estate planning guidance, and gradual delegation of financial responsibility to younger generations.

Understanding the Complexity

Multigenerational wealth transfer involves much more than simply passing assets from one generation to the next. It encompasses legal structures, tax minimization, family governance, values education, and preparation of heirs to responsibly manage inherited wealth. Each element requires careful consideration and professional expertise to ensure successful outcomes.

Core Estate Planning Strategies

Effective estate planning forms the foundation of successful wealth transfer. The goal is not merely to minimize taxes, but to preserve family wealth, maintain control, and ensure assets are used according to the founder's wishes while supporting beneficiaries' needs and aspirations.

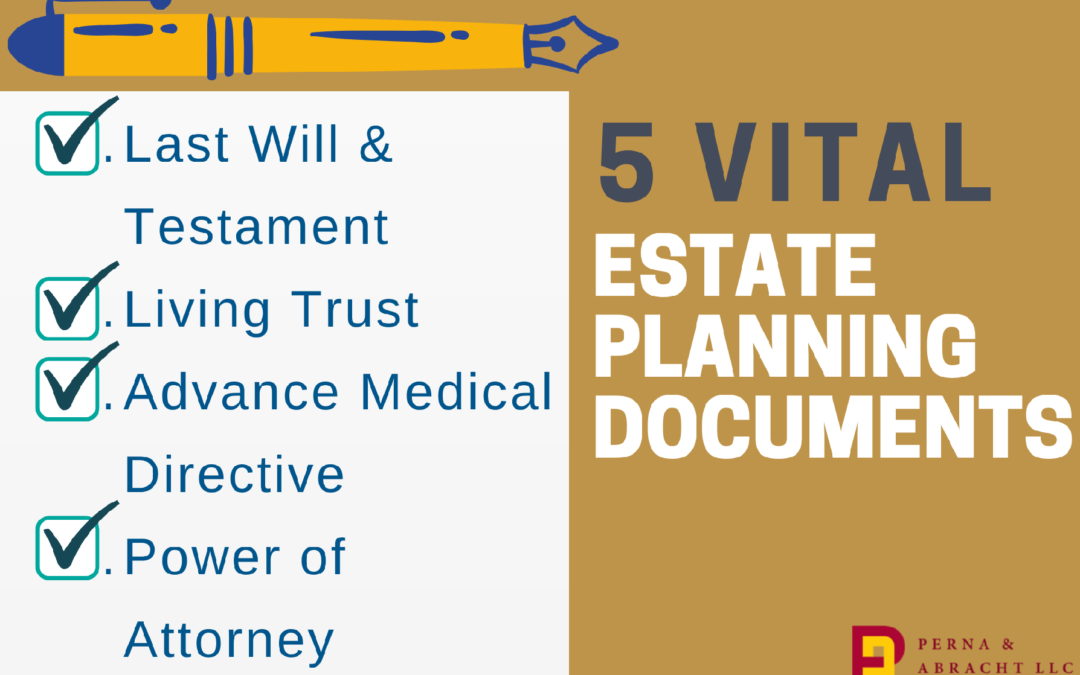

Essential Documents and Structures

Wills and Revocable Trusts

These documents form the basic framework for asset distribution, allowing you to specify how your estate should be divided among beneficiaries while avoiding probate for trust assets.

Irrevocable Trusts

These permanent structures can provide tax benefits, creditor protection, and ensure assets are used according to your specifications while protecting them from beneficiary's creditors and divorces.

Life Insurance Trusts

ILITs can remove life insurance proceeds from your taxable estate while providing liquidity for estate taxes and supporting family financial needs.

Family Limited Partnerships

FLPs can centralize family assets, provide management control, and create discounts for estate and gift tax purposes while maintaining family control.

The Importance of Titling

How assets are titled can have profound implications for wealth transfer. Joint ownership, beneficiary designations, and trust ownership each offer different benefits and should be coordinated with your overall estate plan. Regularly review and update titling to reflect life changes and ensure optimal transfer outcomes.

Tax-Efficient Transfer Strategies

While tax considerations shouldn't be the only factor in wealth transfer planning, minimizing tax burden can significantly increase the amount of wealth available for your beneficiaries. Understanding the tax implications of different transfer strategies is essential for optimal outcomes.

Annual Gift Tax Exclusions

Current annual exclusion amounts allow you to transfer up to $18,000 per beneficiary ($36,000 for married couples) without using your lifetime exemption. These gifts can be made in cash, securities, or other assets, and can be particularly effective when made to trusts to provide additional benefits and protections.

Lifetime Exemption Utilization

With current lifetime exemption amounts exceeding $13 million per individual ($26 million for married couples), many families can make significant transfers without immediate tax liability. Strategic use of these exemptions during lifetime can reduce future estate tax burdens while providing immediate benefits to beneficiaries.

Grantor Retained Annuity Trusts (GRATs)

GRATs allow you to transfer appreciation in assets to beneficiaries with minimal gift tax consequences. The grantor retains annuity payments for a specified period, after which the remaining assets pass to beneficiaries tax-free. This strategy is particularly effective for transferring highly appreciating assets.

Case Study: The Johnson Family GRAT Strategy

The Johnson family, with a substantial equity stake in a rapidly growing technology company, established a series of GRATs to transfer the appreciated value to their children. By retaining annuity payments for 10 years, they were able to transfer millions in appreciation to the next generation while maintaining liquidity through the retained payments. The strategy saved over $2 million in estate taxes while providing immediate income to the founders.

Charitable Strategies

Charitable giving strategies can provide significant tax benefits while supporting meaningful causes. Charitable remainder trusts can provide income for life while ultimately benefiting charities, while charitable lead trusts can transfer appreciation to family members while providing income streams to favored charities.

Tax Planning Considerations

Estate and gift tax laws are subject to change, and what appears optimal today may not be the best strategy in the future. Working with qualified tax and legal professionals to regularly review and update your estate plan ensures you take advantage of current opportunities while adapting to changing laws.

Family Governance and Values Transmission

Preserving wealth across generations requires more than financial planning—it demands careful attention to family governance, values transmission, and education of heirs. Families that successfully transfer wealth over multiple generations typically establish formal governance structures and communication frameworks.

Family Mission and Values

Creating a clear family mission statement and documenting shared values provides the philosophical foundation for wealth transfer decisions. These statements should articulate not just how wealth should be used, but also the principles that guide family member behavior and decision-making.

Family Mission Development Checklist

- Define core family values and principles

- Articulate the purpose of family wealth

- Establish guidelines for wealth use and preservation

- Create expectations for family member contributions

- Develop procedures for conflict resolution

- Set guidelines for philanthropy and giving

Family Meetings and Communication

Regular family meetings provide opportunities for open communication about wealth, expectations, and plans. These meetings should include discussions of financial education, estate planning updates, family business matters, and philanthropic activities. Structured communication helps prevent misunderstandings and builds trust between generations.

Educational Programs

Comprehensive financial education programs prepare younger family members for eventual wealth responsibility. These programs might include:

- Personal financial management education

- Investment and portfolio management principles

- Business and entrepreneurship skills

- Philanthropic planning and implementation

- Leadership development and governance training

- Legal and tax education related to wealth ownership

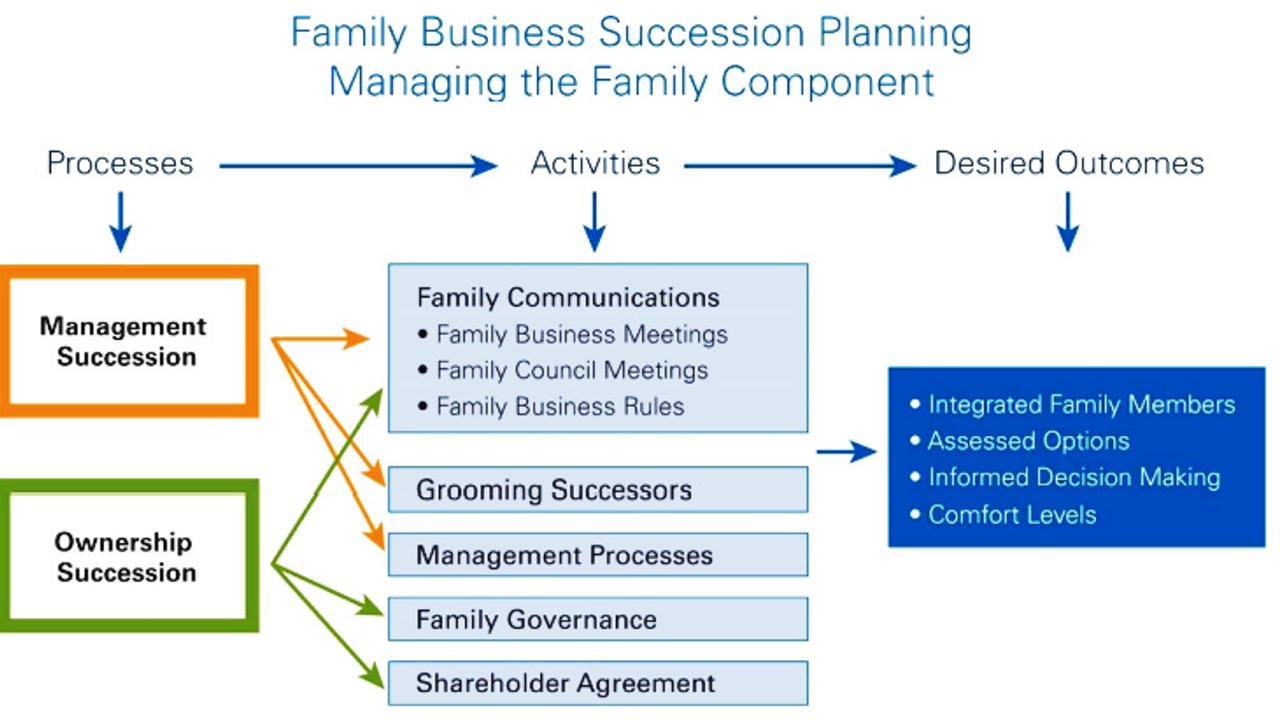

Succession Planning

Preparing the next generation for leadership roles requires deliberate planning and gradual responsibility delegation. This process should begin early, with younger family members taking on increasing levels of responsibility and decision-making authority over time. Successful succession planning ensures continuity of family values and business operations while maintaining family harmony.

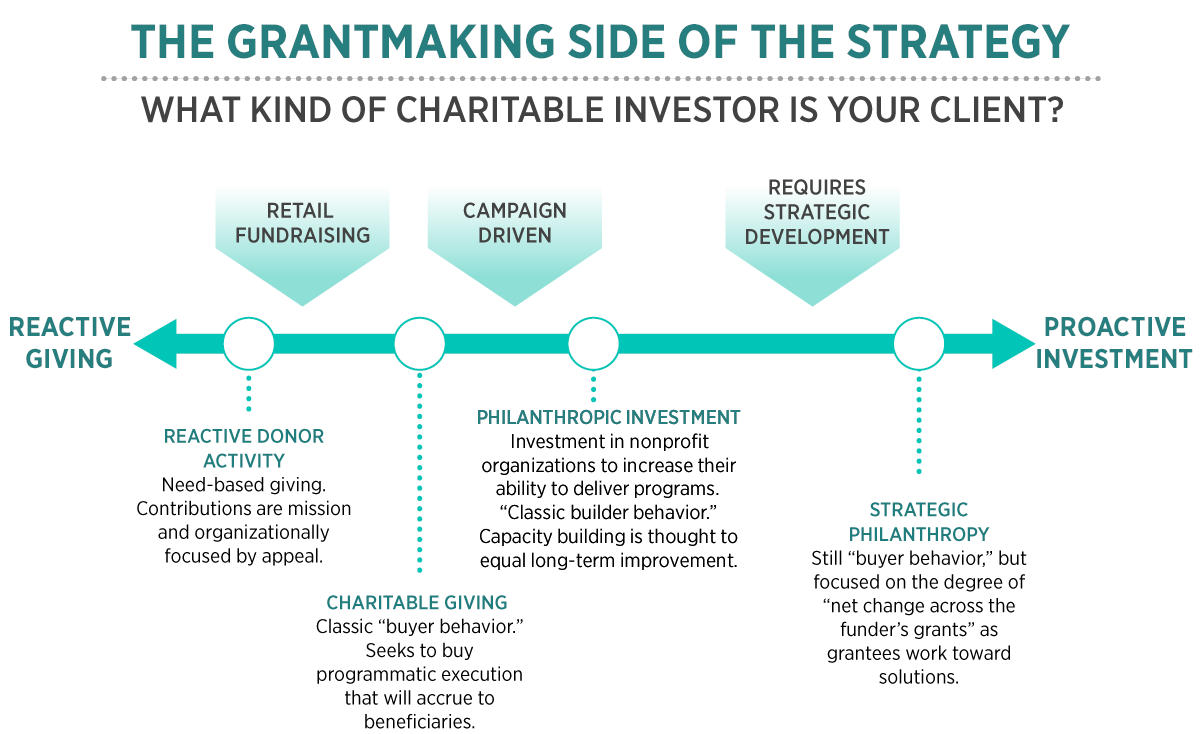

Philanthropic Wealth Transfer

Many families use charitable giving as both a tax-efficient wealth transfer strategy and a means of teaching younger generations about social responsibility. Philanthropic activities can unite family members around common goals while providing significant financial benefits.

Donor-Advised Funds

DAFs provide immediate tax benefits while allowing families to make strategic charitable contributions over time. Younger family members can participate in grant-making decisions, learning about effective philanthropy while staying connected to family values.

Family Foundations

Private foundations offer families greater control over charitable activities while providing significant tax benefits. Foundations require substantial administration but can serve as powerful tools for family education, values transmission, and long-term philanthropic planning.

Charitable Trusts

Various charitable trust structures can provide income for life or specific periods while supporting charitable causes. These tools can be particularly effective for high-net-worth families seeking to transfer appreciated assets while supporting meaningful causes.

Case Study: The Miller Family Foundation

The Miller family established a private foundation to formalize their philanthropic activities and engage younger family members in charitable planning. The foundation required annual giving minimums but allowed family members to propose grants in areas of personal interest. Over ten years, this approach resulted in $15 million in total giving while educating three generations about effective philanthropy and maintaining strong family connections around shared values.

Business Succession Planning

For families with closely-held businesses, succession planning presents unique challenges and opportunities. The goal is to ensure business continuity while managing tax implications and family dynamics. Business succession plans should address leadership transition, ownership transfer, and valuation considerations.

Succession Timeline Development

Effective business succession planning should begin 5-10 years before the planned transition. This timeline allows for gradual preparation of successors, tax planning, and relationship building with key stakeholders. A well-structured timeline reduces pressure on all parties and allows for thoughtful decision-making.

Successor Preparation

Preparing successors involves more than transferring ownership—it requires developing the skills, knowledge, and relationships necessary for successful leadership. This preparation might include formal education, external experience, mentorship programs, and progressive responsibility within the business.

Buy-Sell Agreements

Comprehensive buy-sell agreements provide structure for ownership transitions and protect both the business and departing owners. These agreements should address valuation methods, payment terms, funding mechanisms, and restrictions on ownership transfer to ensure continuity and fair treatment of all parties.

Tax-Efficient Structures

Various legal structures can optimize the tax efficiency of business transfers while ensuring fair treatment of family members. Installment sales, private annuities, self-canceling installment notes, and family limited partnerships each offer unique advantages depending on specific circumstances.

Business Succession Best Practices

Successful business succession requires: early planning and preparation, clear communication of expectations, formal training and development programs, appropriate compensation and incentive structures, and professional valuation and tax planning guidance.

Asset Protection Strategies

Protecting inherited wealth from potential threats including creditors, divorces, poor financial decisions, and market volatility is essential for multigenerational preservation. Various legal structures and strategies can provide different levels of protection while maintaining family control.

Trust Structures

Different types of trusts offer varying levels of asset protection:

- Domestic Asset Protection Trusts: Available in certain states, these trusts provide strong creditor protection for beneficiaries

- Spendthrift Trusts: Restrict beneficiary access to principal, protecting against poor financial decisions and creditor claims

- Generation-Skipping Trusts: Can protect assets for multiple generations while providing tax benefits

Ownership Considerations

How beneficiaries receive and hold assets affects their protection. Direct ownership provides maximum control but minimal protection, while trust ownership offers various levels of protection with different degrees of control. Balancing protection and flexibility requires careful consideration of family circumstances and beneficiary maturity.

Insurance Planning

Comprehensive insurance planning can protect family wealth from unexpected events including business liabilities, personal injury claims, and premature death. Key types include liability insurance, key person insurance, and life insurance held in irrevocable life insurance trusts.

Coordination with Estate Planning

Asset protection strategies should be coordinated with overall estate planning to ensure optimal outcomes. What works well for protection may create complexity in estate administration, and vice versa. Professional guidance helps balance these competing objectives.

Technology and Digital Asset Planning

Modern wealth transfer planning must address the growing importance of digital assets including cryptocurrency, online business holdings, social media accounts, and digital intellectual property. Traditional estate planning documents often fail to address these assets adequately.

Digital Asset Inventory

Comprehensive planning requires creating detailed inventories of digital assets including login credentials, locations, and transfer instructions. This inventory should be regularly updated and securely stored with appropriate access controls.

Cryptoasset Planning

Cryptocurrency and other digital assets present unique challenges for estate planning including private key management, wallet access, and tax implications. Specialized guidance is often required for optimal planning outcomes.

Online Business Holdings

Many families now operate substantial business interests online including websites, mobile applications, and digital marketing platforms. These assets require specific planning considerations including succession planning, valuation, and operational continuity.

Common Wealth Transfer Mistakes

Understanding common mistakes in wealth transfer planning can help families avoid costly and potentially irreversible errors. The most significant mistakes often involve inadequate planning, poor communication, and failure to adapt strategies over time.

Inadequate Communication

Failing to communicate wealth transfer plans with family members often leads to misunderstandings, unexpected tax consequences, and family conflict. Open, honest communication about wealth, expectations, and plans is essential for successful outcomes.

Insufficient Planning Time

Starting estate planning too late can limit available strategies and force decisions under pressure. Beginning planning early allows for gradual implementation of strategies, tax optimization, and family education.

Ignoring Tax Changes

Estate and gift tax laws change frequently, and outdated plans may no longer be optimal or may fail to take advantage of current opportunities. Regular plan reviews and updates ensure ongoing optimization.

Inadequate Professional Coordination

Estate planning involves multiple disciplines including legal, tax, financial planning, and business succession. Inadequate coordination between professionals can result in suboptimal outcomes or implementation problems.

Overlooking Family Dynamics

Technical planning perfection cannot overcome poor family relationships or inadequate preparation of heirs. Addressing family dynamics and preparing beneficiaries for wealth responsibility is as important as optimal tax strategies.

Working with Professional Advisors

Multigenerational wealth transfer planning requires expertise across multiple disciplines. Working with qualified professionals ensures comprehensive planning and proper implementation while maximizing the effectiveness of available strategies.

Core Professional Team

An effective wealth transfer planning team typically includes:

- Estate Planning Attorney: Designs legal structures and documents

- Tax Professional: Optimizes tax efficiency and compliance

- Financial Advisor: Manages investments and financial planning

- Business Succession Specialist: Addresses business transfer challenges

- Philanthropic Advisor: Structures charitable giving strategies

Ongoing Relationship Management

Wealth transfer planning is not a one-time event but an ongoing process requiring regular reviews and updates. Professional advisors should provide regular check-ins, annual plan reviews, and proactive recommendations for plan optimization.

Choosing Your Advisory Team

Select advisors who understand your family values and long-term objectives, have experience with multigenerational planning, demonstrate strong communication skills, and work collaboratively with other professionals. Regular team meetings ensure coordinated planning and consistent implementation.

Implementation and Monitoring

Developing a comprehensive wealth transfer plan is only the first step—successful implementation requires careful execution, ongoing monitoring, and periodic adjustments based on changing circumstances and regulations.

Implementation Checklist

- Execute all legal documents according to plan specifications

- Transfer asset titles as planned

- Establish necessary trust accounts and funding mechanisms

- Coordinate beneficiary designations across all accounts

- Implement tax strategies through appropriate transactions

- Begin family education and governance programs

- Schedule regular review meetings with professional advisors

Regular Monitoring

Ongoing monitoring ensures your wealth transfer plan remains effective and adapts to changing circumstances. This includes annual plan reviews, beneficiary updates, asset rebalancing, and tax law changes.

Lifecycle Adaptations

Wealth transfer plans should adapt to significant life changes including marriage, divorce, births, deaths, business changes, and regulatory modifications. Flexibility within legal structures allows for adaptation without complete restructuring.

Conclusion: Building a Lasting Legacy

Multigenerational wealth transfer represents one of the most complex challenges facing affluent families today. Success requires careful planning across legal, tax, financial, and relational dimensions, combined with ongoing commitment to family education and values transmission.

The families that successfully preserve and transfer wealth across generations share common characteristics: they begin planning early, maintain open communication, invest in family education, work with qualified professional advisors, and remain flexible enough to adapt to changing circumstances. Most importantly, they recognize that wealth transfer is not merely about passing assets—it's about perpetuating family values, ensuring opportunity for future generations, and making meaningful contributions to society.

Your Wealth Transfer Journey

Every family's wealth transfer journey is unique, reflecting individual circumstances, values, and objectives. Whether you're beginning to think about succession planning or seeking to optimize an existing plan, professional guidance can help you navigate the complexity while building a lasting legacy for future generations.

The time to begin multigenerational planning is now. With proper preparation, professional guidance, and family commitment, you can create a legacy that endures far beyond your lifetime, providing opportunities and security for generations to come while making a positive impact on your community and the world.

Ready to Begin Your Wealth Transfer Planning?

Contact Jeff Allen Fink today to discuss how multigenerational wealth transfer strategies can help preserve your family's legacy while providing tax-efficient outcomes and preparing the next generation for financial responsibility.