The traditional approach to retirement planning—accumulate assets, then withdraw systematically—faces unprecedented challenges in today's volatile market environment. As someone who has guided hundreds of clients through market cycles over two decades, I've witnessed firsthand how sudden market shifts can derail even the most carefully constructed retirement plans.

This reality demands a fundamental rethinking of retirement strategy. Rather than viewing volatility as an obstacle to overcome, we can transform it into an opportunity by implementing adaptive planning frameworks that build resilience into every aspect of your financial future.

The New Retirement Reality

Market volatility isn't a temporary inconvenience—it's a permanent feature of modern markets. Successful retirement planning in the 21st century requires strategies that perform well across multiple market conditions, not just during bull markets.

Understanding Modern Market Volatility

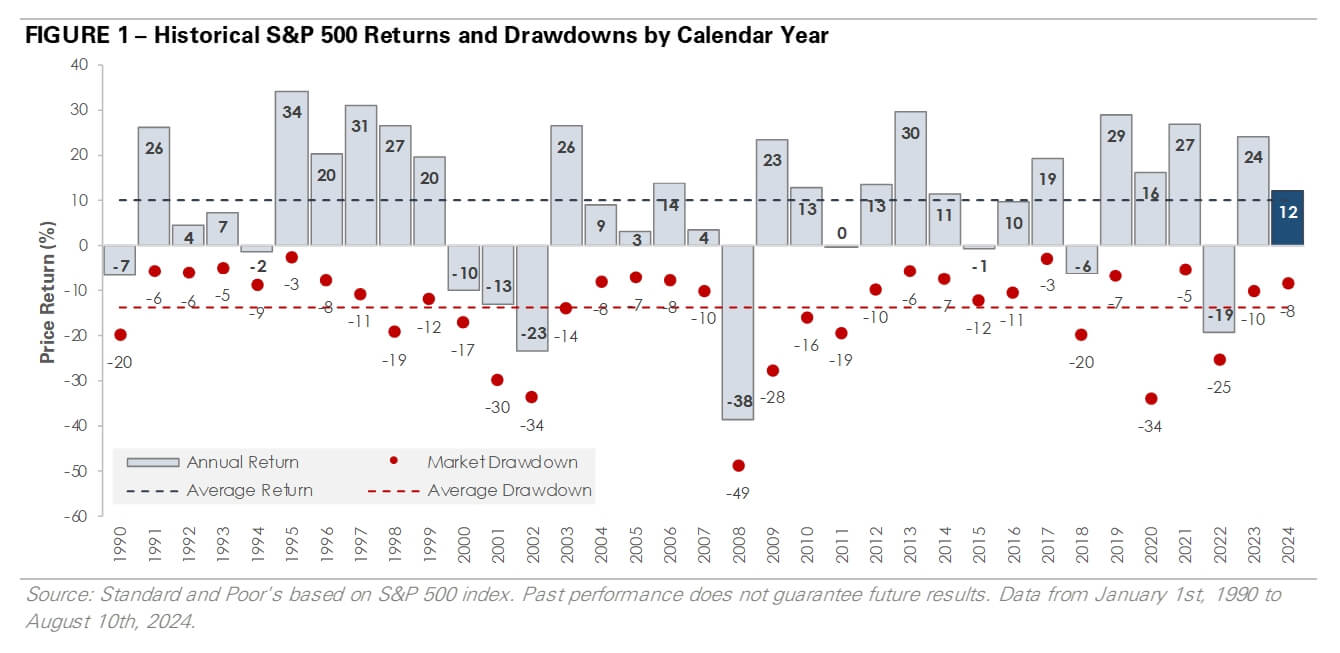

Market volatility has intensified significantly over the past two decades, driven by factors ranging from technological disruption to global economic interconnectedness. For retirees and those approaching retirement, this creates unique challenges that traditional planning models weren't designed to address.

Consider the historical context: From 1970 to 2000, the S&P 500 experienced an average annual decline of 5% or more only once every 3-4 years. Since 2000, such declines have occurred approximately once per year, with several years experiencing declines exceeding 15%.

Key Volatility Drivers in Today's Markets

- Technological Disruption: Rapid innovation cycles create sudden winners and losers

- Global Interconnectedness: Events in one region cascade across global markets instantly

- Central Bank Policy: Quantitative easing and interest rate manipulation affect valuations

- Geopolitical Tensions: Trade wars and political instability impact investor confidence

- Information Velocity: Social media and instant news create rapid sentiment shifts

The Traditional Planning Problem

The conventional wisdom of retirement planning—accumulate a diversified portfolio, then withdraw 4% annually—was developed during a period of relatively stable markets and higher bond yields. This approach faces several critical challenges in today's environment:

Sequence of Returns Risk

Perhaps the most significant threat to retirement security is the sequence of returns risk—the danger that market downturns occur early in your retirement years, when you have the least time to recover. A 20-year retirement starting in 2000 with the S&P 500 would have experienced dramatically different outcomes depending on whether the downturn occurred in years 1-3 versus years 15-17.

Case Study: The Importance of Sequence

Two retirees, both with identical $1 million portfolios and identical spending needs, but who retired at different times during market volatility. The timing of their market exposure determined whether their wealth lasted 20+ years or was depleted within 15 years.

Fixed Income Challenges

For decades, retirees could rely on bonds to provide both income and portfolio stability. Today's near-zero interest rates have fundamentally altered this equation, making it impossible to generate meaningful income from bonds without accepting substantial duration risk.

Adaptive Retirement Strategies

Rather than abandoning proven investment principles, we need to evolve our approach. Here are the key strategies I'm implementing with clients to build retirement resilience:

1. Dynamic Asset Allocation

Static portfolio models assume that the same allocation that worked in the past will continue to work in the future. Dynamic allocation adjusts based on market conditions, valuation levels, and economic indicators.

Dynamic Allocation Principles:

- Reduce equity exposure when valuations are extreme (like late 2021)

- Increase equity exposure after significant market declines

- Maintain inflation hedges as part of the core allocation

- Adjust bond duration based on interest rate expectations

- Include alternative assets for portfolio diversification

2. Bucket Strategy Evolution

The traditional three-bucket approach (cash, bonds, stocks) can be enhanced with additional buckets designed for different market conditions:

- Cash Bucket (Years 0-2): Immediate expenses and emergency buffer

- Fixed Income Bucket (Years 3-7): High-quality bonds and income-generating assets

- Growth Bucket (Years 8+): Equities and growth-oriented investments

- Opportunity Bucket: Reserve funds to deploy during market dislocations

- Insurance Bucket: Strategies to protect against longevity and market risks

3. Income Floor with Upside Potential

Create a guaranteed income floor that covers essential expenses, then build in flexibility for discretionary spending based on portfolio performance. This approach reduces the pressure to take excessive risks while maintaining lifestyle quality.

Income Floor Components:

Social Security optimization, pension income, immediate annuities for core expenses, and systematic withdrawal planning for discretionary spending.

Risk Management in Practice

Effective risk management goes beyond diversification—it requires understanding which risks to hedge, which to accept, and which to transfer to insurance mechanisms.

Market Risk Management

- Volatility-Based Rebalancing: Adjust allocations when portfolio volatility exceeds targets

- Valuation-Based Selling: Take profits when asset classes become historically expensive

- Defensive Positioning: Reduce equity exposure during economic uncertainty

- Opportunistic Buying: Maintain cash reserves for market dislocations

Longevity Risk Protection

With life expectancy continuing to increase, the risk of outliving your assets becomes paramount. Several strategies can address this concern:

Longevity Protection Strategies:

- Deferred income annuities for guaranteed lifetime income

- Protected equity strategies that provide downside protection

- Variable annuities with living benefit riders

- Systematic longevity insurance starting at age 80

- Healthcare cost planning and long-term care insurance

Tax-Efficient Implementation

Taxes can erode 30-40% of retirement income over a lifetime. Strategic tax planning becomes even more critical in volatile markets where gains and losses can fluctuate dramatically.

Tax-Loss Harvesting in Retirement

Rather than avoiding losses, tax-loss harvesting turns market volatility into tax savings. By systematically selling losing positions and immediately repurchasing similar (but not identical) assets, you can:

- Offset capital gains from portfolio rebalancing

- Reduce current-year tax liability

- Maintain desired market exposure

- Create carryforward losses for future years

Roth Conversion Strategies

Market downturns create opportunities for tax-efficient Roth conversions. Converting appreciated assets during market lows can significantly reduce the tax burden while shifting future growth to tax-free status.

Real-World Application: A Case Study

Consider the scenario of Margaret, a 62-year-old retiree with $2.8 million in retirement savings. Traditional planning might suggest a 4% withdrawal rate, generating $112,000 annually. However, applying adaptive strategies creates a more resilient approach:

Margaret's Adaptive Plan

- Income Floor ($80,000): Guaranteed from Social Security and annuities

- Discretionary Income ($40,000): Systematic withdrawals based on portfolio performance

- Opportunity Reserve ($200,000): Cash for market dislocations

- Growth Allocation (50-70%): Equity exposure based on market conditions

This approach provides Margaret with more income security than traditional planning, along with the flexibility to increase spending during favorable markets and reduce spending during downturns.

The Importance of Professional Guidance

While these strategies provide a framework for retirement planning in volatile markets, implementation requires expertise and ongoing monitoring. Market conditions change rapidly, and what works in one environment may need adjustment in another.

A qualified financial advisor can help you:

- Customize strategies based on your specific financial situation

- Navigate complex tax implications

- Adapt plans as market conditions evolve

- Coordinate with your legal and tax professionals

- Provide objective guidance during emotional market periods

When to Seek Professional Guidance

Complex financial situations, significant portfolio sizes, multiple income sources, substantial tax considerations, and estate planning needs all warrant professional assistance. The complexity of modern retirement planning makes expert guidance not just helpful, but essential.

Looking Ahead: Preparing for the Unknown

The only certainty about future markets is their uncertainty. By building adaptive strategies that work across different market conditions, retirees can approach the future with confidence rather than anxiety.

Key Takeaways for Retirement Success

Essential Principles for Modern Retirement:

- Embrace flexibility over rigid withdrawal formulas

- Prioritize income security over maximum returns

- Use market volatility as an opportunity, not a threat

- Plan for multiple scenarios, not just the most likely outcome

- Maintain professional guidance for complex decisions

- Review and adjust plans regularly as conditions change

- Focus on factors within your control (spending, taxes, planning)

- Build in safeguards against longevity and market risks

The goal isn't to predict market movements—it's to build a plan that performs reasonably well across multiple scenarios. In today's volatile environment, this adaptive approach to retirement planning isn't just wise; it's essential for long-term financial security.