Understanding Strategic Asset Allocation

Strategic asset allocation represents a long-term, disciplined approach to portfolio construction that aims to balance risk and return through diversified investment across multiple asset classes. Unlike tactical allocation, which involves frequent adjustments based on market conditions, strategic allocation establishes a target portfolio mix based on an investor's goals, risk tolerance, and time horizon.

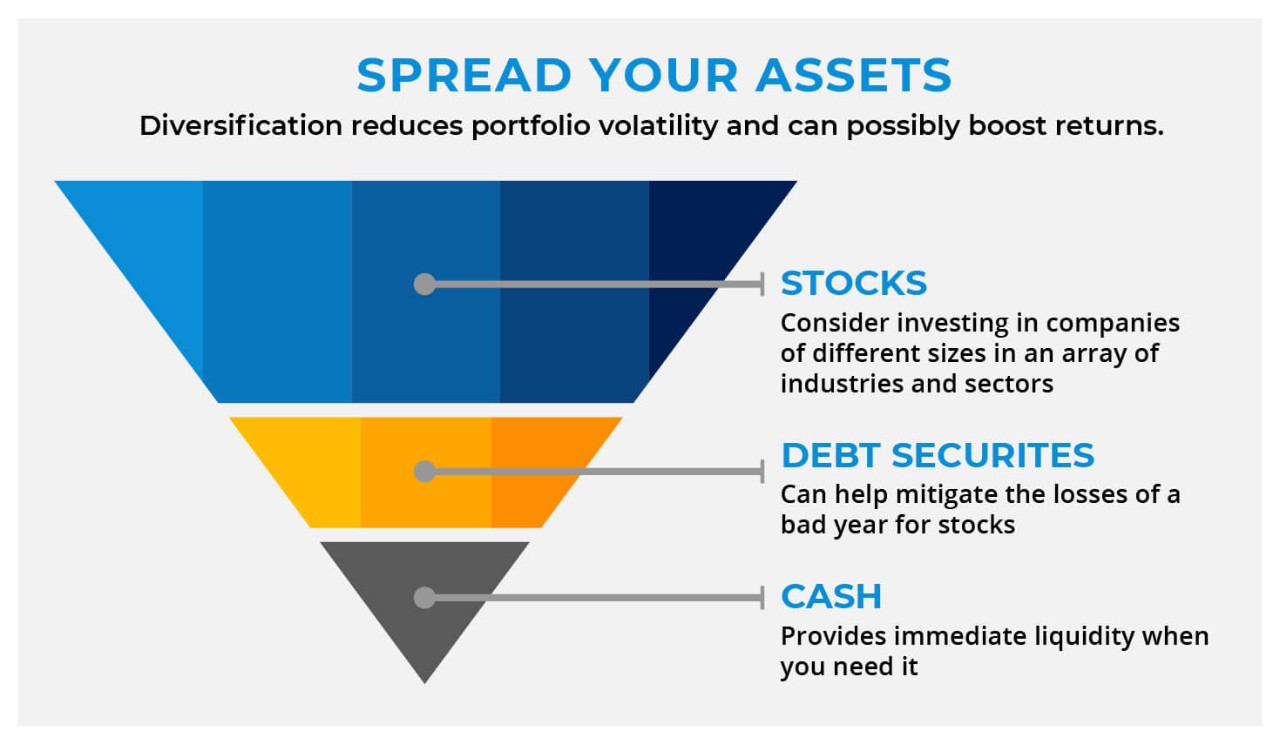

The foundation of strategic asset allocation lies in the principle that different asset classes exhibit varying risk-return characteristics and often perform differently under various market conditions. By combining these diverse assets in carefully considered proportions, investors can potentially reduce portfolio volatility while pursuing their desired returns.

Key Principle: Correlation and Diversification

The effectiveness of strategic asset allocation depends largely on the correlation between asset classes. When asset classes have low or negative correlations, they tend not to move in the same direction at the same time, providing natural portfolio protection during market downturns.

The Historical Perspective

The concept of strategic asset allocation emerged from decades of financial research, particularly the pioneering work of Harry Markowitz on Modern Portfolio Theory in the 1950s. This framework demonstrated that investors could construct portfolios that offered the maximum expected return for a given level of risk, or alternatively, the minimum risk for a desired level of return.

Subsequent research by academics and practitioners has consistently shown that asset allocation is responsible for the vast majority of portfolio returns over time. Studies suggest that asset allocation decisions typically account for approximately 90% of long-term portfolio performance variability, making it far more important than individual security selection or market timing.

The Four Pillars of Asset Class Construction

Successful strategic asset allocation begins with understanding the fundamental characteristics of major asset classes. Each category plays a distinct role in portfolio construction, offering different benefits in terms of growth potential, income generation, and risk mitigation.

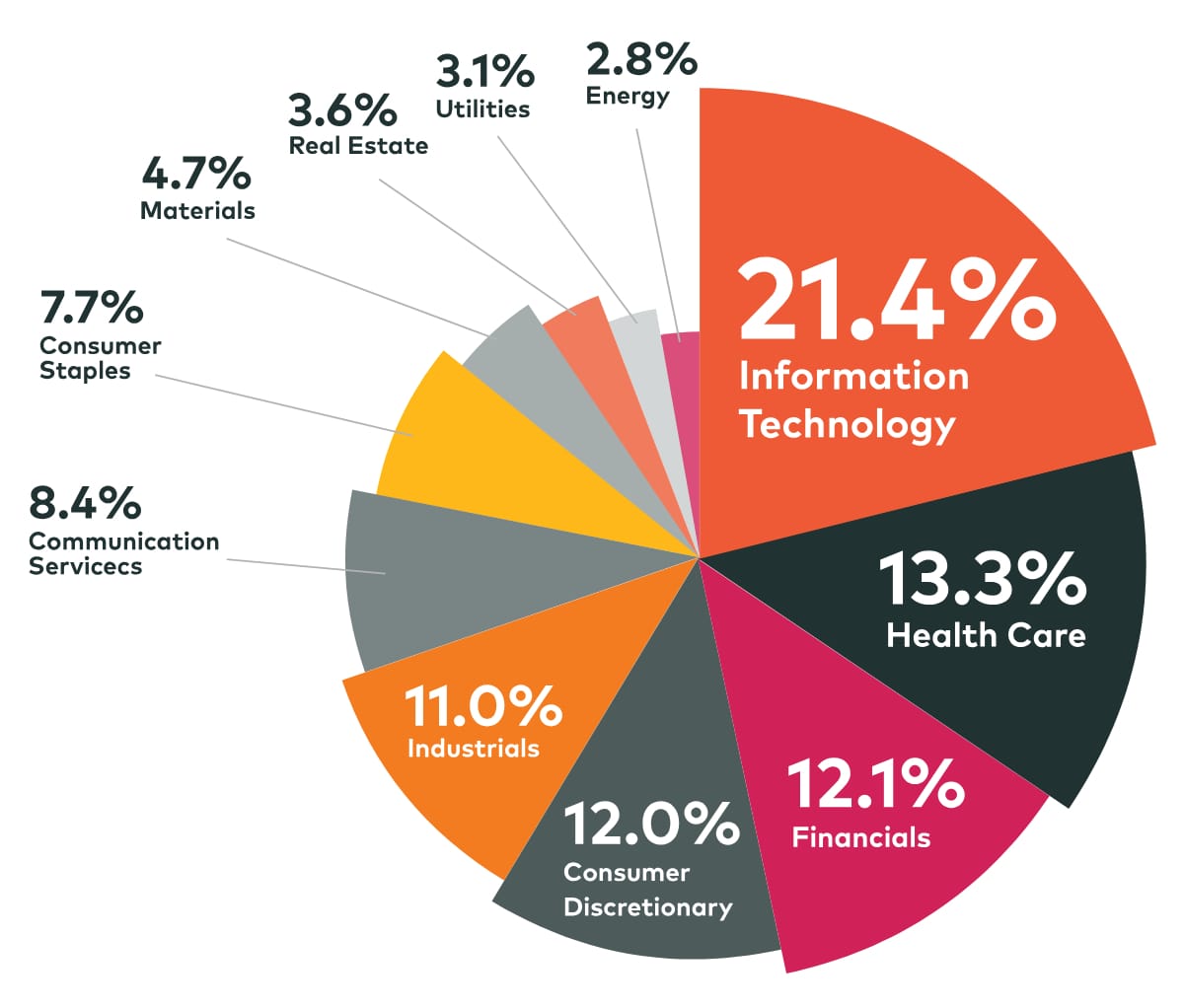

1. Equities (Stocks)

Equities represent ownership in companies and have historically provided the highest long-term returns among major asset classes. However, this comes with increased volatility and the potential for significant short-term losses. Within equities, investors can further diversify by geography, company size, and sector.

- Large-Cap Stocks: Typically more stable, established companies with lower volatility

- Small-Cap Stocks: Higher growth potential but increased price volatility

- International Equities: Provide geographic diversification and exposure to different economic cycles

- Emerging Markets: Higher growth potential with increased political and currency risks

2. Fixed Income (Bonds)

Bonds provide steady income streams and typically offer lower volatility than equities. They tend to perform well during economic downturns when investors seek safety and when interest rates decline. The bond universe includes government bonds, corporate bonds, municipal bonds, and international bonds.

- Government Bonds: Lowest credit risk, often considered safe-haven assets

- Corporate Bonds: Higher yields with increased credit risk

- Municipal Bonds: Tax advantages for high-income investors

- International Bonds: Currency and geographic diversification

3. Alternative Investments

Alternative investments offer diversification benefits and potential for unique return patterns. These include real estate, commodities, hedge funds, and private equity. While historically less liquid, they can provide valuable portfolio characteristics when markets are turbulent.

4. Cash and Cash Equivalents

Cash and short-term securities provide liquidity and capital preservation. While offering the lowest returns, they serve as a stabilizing force in portfolios and provide purchasing power for rebalancing and opportunistic investments.

Risk Management Through Asset Allocation

One of the most compelling arguments for strategic asset allocation is its power to manage risk without necessarily sacrificing returns. By understanding the risk-return characteristics of different asset classes, investors can construct portfolios that align with their risk tolerance while pursuing appropriate growth objectives.

Understanding Portfolio Risk

Portfolio risk is more complex than simply adding up the risks of individual investments. The interactions between assets can either amplify or reduce overall portfolio risk. This phenomenon, known as correlation, forms the mathematical foundation for the risk-reduction benefits of diversification.

| Asset Class | Historical Volatility | Typical Correlation to Stocks | Role in Portfolio |

|---|---|---|---|

| Large-Cap Stocks | 16-18% | 1.00 | Growth engine |

| Small-Cap Stocks | 20-25% | 0.85 | Enhanced growth |

| International Stocks | 18-22% | 0.75 | Geographic diversification |

| Investment-Grade Bonds | 4-6% | -0.20 | Stability and income |

| Real Estate | 15-20% | 0.60 | Inflation hedge |

| Commodities | 20-25% | 0.30 | Inflation protection |

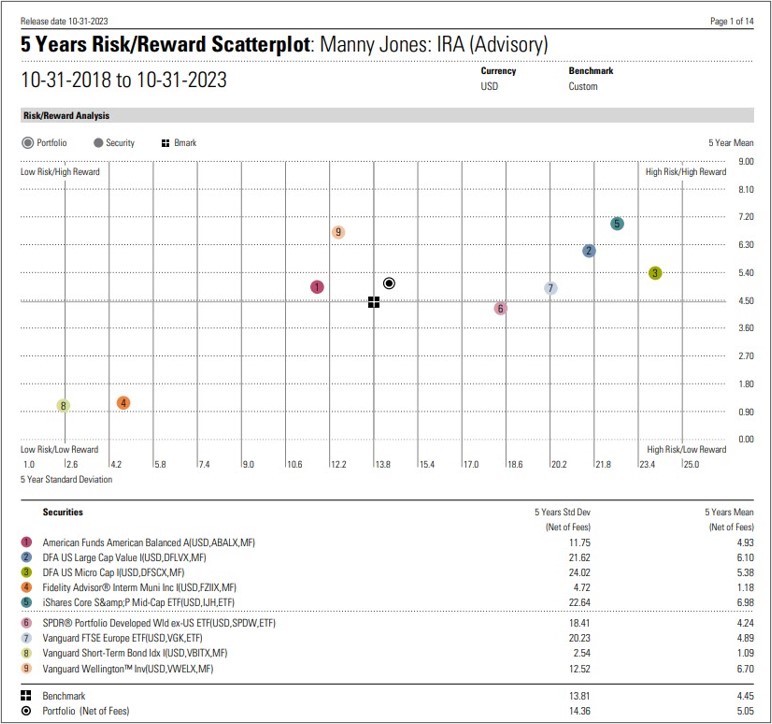

The Efficient Frontier

The concept of the efficient frontier, introduced by Modern Portfolio Theory, illustrates how different combinations of assets can achieve varying levels of risk and return. Portfolios on the efficient frontier offer the highest expected return for their level of risk, or conversely, the lowest risk for their expected return.

Strategic asset allocation aims to position portfolios on or near this efficient frontier, optimizing the risk-return trade-off based on individual circumstances and preferences. This mathematical framework provides a disciplined approach to portfolio construction that goes beyond gut feelings or market predictions.

Implementing Strategic Allocation

Translating theoretical asset allocation into a practical investment strategy requires careful consideration of several key factors. The process begins with a comprehensive evaluation of your financial situation, goals, and constraints.

Step 1: Define Your Investment Objectives

Clear investment objectives form the foundation of any successful allocation strategy. This includes identifying specific goals such as retirement planning, education funding, home purchase, or wealth preservation. Each goal should have a defined time horizon and dollar target.

Time Horizon Considerations

Your investment timeline significantly influences appropriate asset allocation. Longer time horizons generally allow for greater equity exposure, while shorter horizons require more conservative allocations. A 25-year-old saving for retirement can typically tolerate more risk than a 62-year-old planning to retire in three years.

Step 2: Assess Risk Tolerance

Risk tolerance encompasses both your emotional capacity to withstand market volatility and your financial ability to handle potential losses. This involves honest self-reflection about how you would react to various market scenarios, particularly significant downturns.

Step 3: Determine Asset Mix

Based on your objectives and risk assessment, you can develop a target asset allocation. This involves selecting appropriate percentages for each asset class that balance your growth needs with your risk comfort level.

Step 4: Select Investments

With your allocation targets established, the next step is selecting specific investments that provide exposure to your chosen asset classes. This might include mutual funds, exchange-traded funds (ETFs), individual securities, or alternative investments.

Step 5: Monitor and Rebalance

Strategic allocation requires ongoing monitoring to ensure your portfolio remains aligned with your target allocation. Market movements can cause asset class weights to drift from their targets, requiring periodic rebalancing to maintain your desired risk-return profile.

Tax-Efficient Asset Location

Beyond determining the right mix of assets, strategic allocation also considers where to house different types of investments from a tax perspective. Asset location – the practice of placing tax-inefficient investments in tax-advantaged accounts and tax-efficient investments in taxable accounts – can enhance after-tax returns.

Tax-Inefficient Investments

These investments typically generate significant taxable income and should generally be held in tax-advantaged accounts:

- Taxable bonds and bond funds

- Real estate investment trusts (REITs)

- Actively managed mutual funds with high turnover

- Alternative investments with complicated tax treatment

Tax-Efficient Investments

These investments should typically go in taxable accounts:

- Index funds with low turnover

- Tax-managed funds

- Individual stocks held long-term

- Municipal bonds for high-income investors

Case Study: The Tax Efficiency Impact

Consider a high-income investor with a 35% federal tax rate and access to both taxable and tax-advantaged accounts. By placing a tax-inefficient REIT fund in their IRA and a tax-efficient index fund in their taxable account, they could potentially save thousands of dollars in taxes annually, enhancing their overall investment returns.

Advanced Allocation Strategies

While traditional strategic allocation focuses on static targets, modern approaches incorporate dynamic elements that can enhance portfolio performance while maintaining the core benefits of diversification.

Risk Parity Allocation

This approach equalizes risk across asset classes rather than capital allocation. By allocating more to lower-volatility assets and less to higher-volatility assets, risk parity aims to create more balanced portfolios that may perform better across different market conditions.

Dynamic Strategic Allocation

Some practitioners incorporate gradual adjustments to strategic allocation based on market valuations or economic indicators. For example, increasing bond allocation when equity valuations appear stretched or reducing international exposure during periods of elevated currency volatility.

ESG Integration

Environmental, Social, and Governance (ESG) factors are increasingly incorporated into strategic allocation decisions. While ESG funds may have slightly different risk-return characteristics, the impact on overall portfolio performance is often minimal when properly implemented.

Common Implementation Mistakes

Despite the clear benefits of strategic asset allocation, many investors make avoidable mistakes that undermine portfolio performance and risk management objectives.

1. Over-Rebalancing

Frequent rebalancing can increase costs and potentially harm returns. Most strategic allocation strategies benefit from periodic rebalancing, typically annually or when allocations drift significantly from targets.

2. Ignoring Tax Consequences

Implementing allocation changes without considering tax implications can significantly reduce after-tax returns. Work with tax professionals to understand the tax impact of rebalancing and consider tax-loss harvesting opportunities.

3. Chasing Performance

The temptation to shift allocation based on recent performance can lead to buying high and selling low. Strategic allocation requires discipline to maintain targets despite short-term market movements.

4. Underestimating Liquidity Needs

Failing to account for potential liquidity needs can force untimely portfolio sales. Maintain adequate cash reserves and consider the liquidity profile of different asset classes when developing your allocation strategy.

5. Inappropriate Complexity

Adding too many asset classes or exotic investments can complicate portfolio management without providing meaningful benefits. Simple, well-diversified allocation often outperforms complex strategies.

Technology and Asset Allocation

Modern technology has transformed how investors implement and monitor strategic asset allocation strategies. Digital platforms provide powerful tools for portfolio analysis, rebalancing, and performance tracking.

Robo-Advisors

Automated investment platforms use algorithms to implement strategic allocation based on investor profiles. These services can provide sophisticated allocation strategies at lower costs, though they may lack the personalization and ongoing guidance of human advisors.

Portfolio Analytics

Advanced analytics platforms enable real-time monitoring of portfolio risk, correlation, and performance attribution. These tools can help investors understand how their allocation is performing and identify potential areas for improvement.

ESG Screening Tools

Technology has made it easier to incorporate ESG factors into strategic allocation. Screening tools allow investors to align their portfolios with personal values while maintaining appropriate risk-return profiles.

The Future of Strategic Asset Allocation

As financial markets continue to evolve, strategic asset allocation strategies must adapt to new realities. Several trends are shaping the future of portfolio construction and management.

Rising Importance of Alternatives

Lower expected returns from traditional asset classes and increasing market correlations are driving greater interest in alternative investments. Private equity, real assets, and hedge fund strategies are becoming more accessible to individual investors.

Climate Change Considerations

Climate risk is increasingly integrated into strategic allocation decisions. This includes both physical risks from climate change and transition risks from moving to a lower-carbon economy.

Globalization and Fragmentation

While globalization continues, increasing geopolitical tensions and trade disputes are creating new considerations for international allocation. Investors must balance the benefits of global diversification with emerging risks.

Technology Disruption

Rapid technological change is creating new investment opportunities and risks. This affects both individual securities and entire asset classes, requiring ongoing evaluation of allocation strategies.

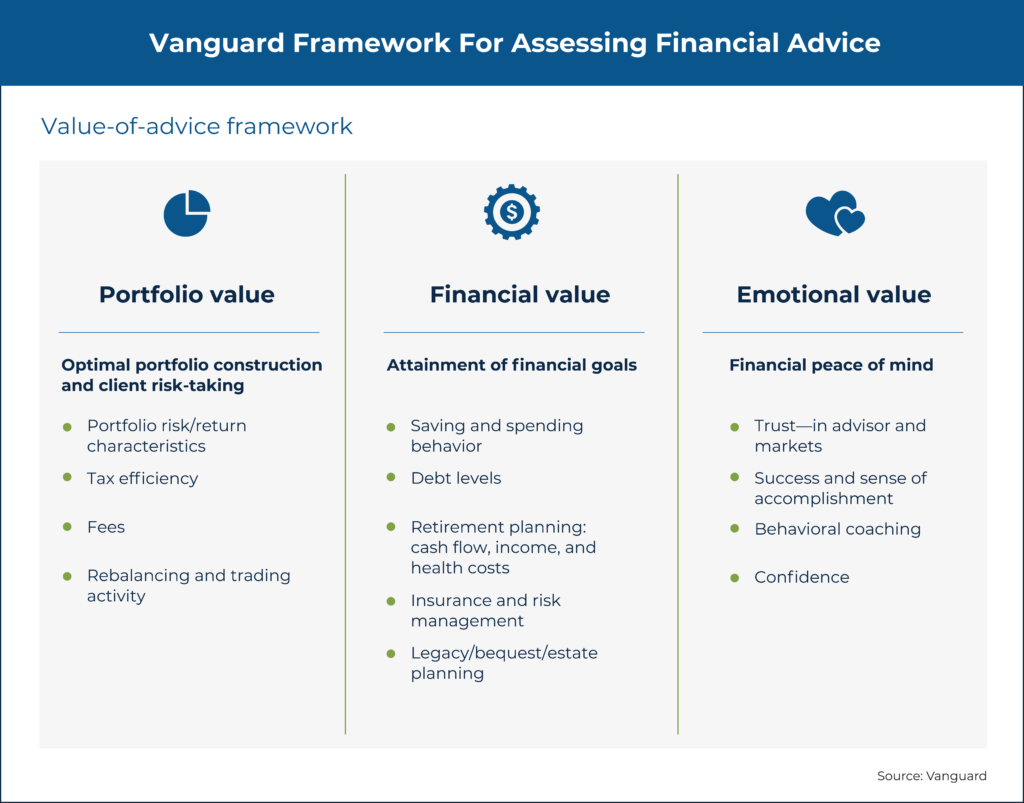

Working with a Financial Advisor

While strategic asset allocation concepts are accessible to individual investors, working with a qualified financial advisor can provide valuable benefits. A professional advisor can help you navigate complex allocation decisions, implement strategies efficiently, and maintain discipline during market volatility.

The Value of Professional Guidance

A skilled advisor brings expertise in portfolio construction, tax planning, and behavioral coaching. They can help you avoid common mistakes, optimize implementation, and maintain focus on long-term objectives despite short-term market movements.

Key Questions for Your Advisor

- What is your approach to strategic asset allocation?

- How do you determine appropriate risk levels for different client profiles?

- What rebalancing methodology do you use?

- How do you incorporate tax efficiency into allocation decisions?

- What technology tools do you use for portfolio monitoring?

- How do you stay current with evolving market conditions and regulations?

Conclusion: Building Your Investment Foundation

Strategic asset allocation represents one of the most powerful concepts in modern investing. By thoughtfully diversifying across different asset classes, investors can potentially enhance returns while managing risk, creating portfolios designed to weather various market conditions while pursuing long-term objectives.

The key to successful strategic allocation lies in developing a disciplined approach based on your unique circumstances, implementing it consistently, and maintaining perspective during market volatility. While no allocation strategy can guarantee profits or prevent losses, strategic allocation provides a framework for making informed investment decisions that align with your goals and risk tolerance.

Your Next Steps

Consider scheduling a consultation to discuss how strategic asset allocation can be tailored to your specific situation. Together, we can evaluate your current portfolio, identify opportunities for improvement, and develop a strategic allocation framework designed to support your long-term financial objectives.

Remember, successful investing is a marathon, not a sprint. Strategic asset allocation provides the roadmap for your investment journey, but the destination depends on your commitment to the process and your ability to stay focused on what truly matters: building long-term wealth for your future and your family's security.

Ready to Optimize Your Asset Allocation?

Contact Jeff Allen Fink today to discuss how strategic asset allocation can help you achieve your financial goals while managing risk effectively. Together, we can design and implement a portfolio strategy tailored to your unique circumstances and objectives.